In this article, we’re providing a comprehensive and free rent vs buy calculator to help you answer one of the most basic (and biggest) budgeting decisions: should you rent or buy a house?

Of course, this calculator also applies to apartments, condos, and any other place you can buy or rent (to live in).

If you want to dive right in, the rent vs buy calculator can be downloaded by entering your email below.

Further below, we’ll provide some more details on why answering the renting vs buying question is important. You’ll also get more details on some of the assumptions that went into the calculator.

High-Level Guide to the Rent vs Buy Calculator:

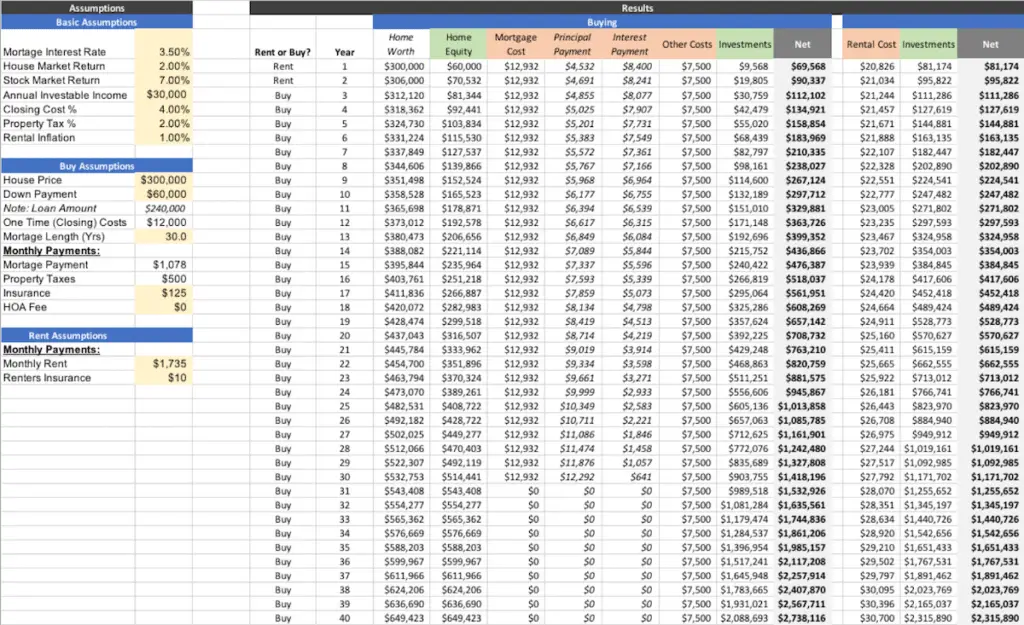

The above image is the rent vs buy calculator dashboard. Full instructions on how to use it can be found on the first tab of the excel. High-level instructions are below:

- Fill in light yellow cells on the left (under the gray “assumptions” box).

- Columns on the right (under the gray “results” box) automatically populate.

- The first column on the right (under the gray “results” box) tells you if you should rent or buy a home depending on how many years you plan to live in that location (based on the assumptions you entered).

Again, more details on the assumptions can be found further below.

Should You Rent or Buy a House?

Deciding to rent or buy a house is largely a complicated, numbers-based decision. That is why we built the comprehensive rent vs buy calculator that helps you make sense of the numbers.

It takes guessing out of that part of the decision.

Though, there are some pros and cons to both renting and buying that go beyond just the numbers. And you don’t need a comprehensive calculator to understand those:

Renting Pros

- Flexibility: When renting, you don’t have the burden of needing to sell your home before being able to move. It’s much easier to relocate on short notice.

- No Maintenance Fees: You are not responsible for any home upkeep or repairs when you are in a rental property. Usually, that falls on the property owner.

- No Taxes or Fees: Even though it’s likely included in the rental price, you do not face any taxes or other reoccurring fees. Just the monthly rent.

Renting Cons

- Not Building Equity: When renting, you are not investing in a property or home. The money you spend monthly is an expense and you will not see it again.

- No Tax Benefits: Just like there are no taxes associated with renting, you also do not get any tax benefits (or deductions) from renting.

- Limited Stability: When renting, at any time (for the most part) the landlord could raise your rent. Or even worse, kick you out. It’s rare, but it can happen.

Buying Pros

- Building Equity: When you buy a home, you are investing in that property and/or home. This is by far the biggest pro to buying a home. The money you spend on your monthly mortgage payment is not an expense, but instead is building equity over time (by paying down debt).

- Ownership: Besides the obvious fact that you own a home, you also own the ability to customize your home how you see fit. On top of that, you own your future – which includes deciding when and if you move. There is no risk of a landlord “kicking you out.”

- Tax Benefit: When you own a home, you get a tax benefit (deduction on your income tax).

Buying Cons

- One Time Expenses: There are a few initial costs and one-time expenses associated with home buying. The most common expense is closing costs. There is an opportunity cost to this large, upfront expense. Instead of getting a +7% annual return on that money in the stock market, that money is gone. It’s a lost opportunity.

- Housing Market Returns: Historically, the housing market has provided lower returns than the general stock market. The calculator addresses this tough question and tradeoff in more detail – is it better to pay less money upfront to rent, and invest the savings in the stock market? Or pay a larger upfront cost and have your monthly payments go to paying down debt?

- Ownership (of costs): Ownership is a pro and also a con. With this ownership, you also own the responsibility of paying for maintenance and repairs. Luckily, insurance and home warranties can usually help with any big surprises.

Rent vs Buy Calculator Assumptions

There are quite a few detailed assumptions that went into building this rent vs buy calculator.

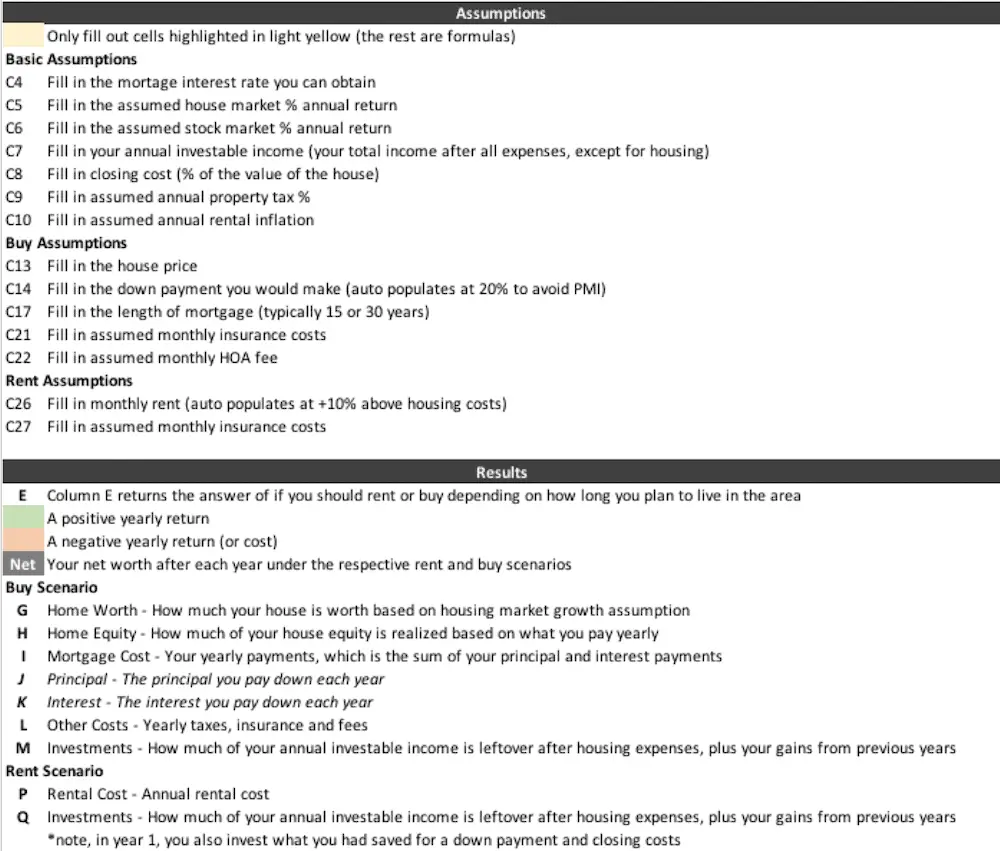

As a reminder, instructions for the calculator are included on the “Instructions” tab. They look like this:

Here are some more details on these assumptions that you need to enter – and how to enter them as accurately as possible:

Basic Assumptions

- Mortgage Interest Rate: Estimate your mortgage interest rate based on your credit score. Or, better yet, reach out to a bank or lender and see what mortgage rate they offer you.

- House Market Return and Home Value: Estimate what you think the housing market will return year over year. Stated otherwise, how much do you think your home price will appreciate in value each year? The default is +2%.

- Stock Market Return: Estimate what you think the stock market will return year over year. Historically, the S&P 500 has had an annual real return of +7%, and that is the default used here as well.

- Annual Investable Income: Input your total investable income (after taxes), but excluding housing expenses. Otherwise stated, after paying for all of your expenses except housing, how much money do you have leftover to save, invest, or spend on housing?

- Closing Cost %: What is a normal percentage to pay in closing cost in your area? As a buyer, this would include things like mortgage fees, attorney fees, appraisal fees, and title costs.

- Property Taxes %: What is the property tax rate for the area you want to live in?

- Rental Inflation Rate: Estimate how much you think rental costs will go up every year based on the area you want to live in. The default is 1%.

Buy Assumptions

- House Price: What is the price of the house you are looking to buy? You can tweak this up or down as you look at the results of the calculator and see what you can afford in terms of a total home purchase price.

- Down Payment: What is the down payment you will make on this house? 20% is recommended to receive a good interest rate and avoid mortgage insurance, but you can pay more or less as you see fit. 20% is the default in the calculator as a starting point.

- Mortgage Length: What is the length of the home loan you wish to take out? 15-year and 30-year fixed loans are both common, with most people opting for 30-year loans.

- Insurance: How much will monthly homeowners insurance cost for your home and belongings? Note, this does not account for mortgage insurance. The default is a very high-level estimate, based on 0.5% of your house cost.

- Homeowner Associate (HOA) Fees: Does the home you are looking at have HOA fees to cover community living fees (this is more common with apartments and condos)?

- Maintenance Costs and Recurring Costs: Annual maintenance costs are not accounted for in this calculator.

Rent Assumptions

- Monthly Rent: Fill in the monthly rent you can afford or want to pay. This likely will be similar to the monthly amount you are willing to pay in the buy scenario, and the default is entered at +10% above your buy assumption costs, assuming that there will be a mark up to rent a similar option.

- Renters Insurance: How much will renters insurance cost per month for your apartment and belongings? The default is $10, as this is usually very cheap.

- Security Deposit: This calculator does not account for a rent security deposit, assuming you will get that back when you move out.

That’s pretty much everything.

Grab the free rent vs buy calculator and answer the biggest real estate debate by signing up below. If you have any questions when playing around in it, reach out.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.