Robo-advisors have been gaining popularity since their inception a few years ago. Today, we’ll compare three of the best robo-advisors available: M1 Finance vs Betterment vs Vanguard.

- M1 Finance: The hybrid model.

- Betterment: The original, full-service robo.

- Vanguard: An essentials-only offering.

As a quick reminder, a robo-advisor is a type of investment platform that uses algorithms and automation to manage your investments.

The benefit of a robo-advisor is that it typically costs less than a traditional financial advisor or money manager and often can provide a similar level of management and advice. For a small fee, you can avoid investing 100% on your own and get some nice perks as well.

The tradeoff with robo-advisors depends on what you are comparing. Compared to money managers, you will lose the human touch, which, depending on who you ask, could be a good or bad thing (eliminating bias could work out in your favor). Compared to investing on your own in index funds or ETFs, it’s potentially going to cost you extra management fees, and you will lose some of your autonomy and control.

All in all, I think robo-advisors fill an excellent middle ground between money managers and investing on your own. They are a great option for beginners, and below, we’ll compare three of the best robo-advisors out there: M1 Finance vs Betterment vs Vanguard Digital Advisor.

M1 Finance Overview

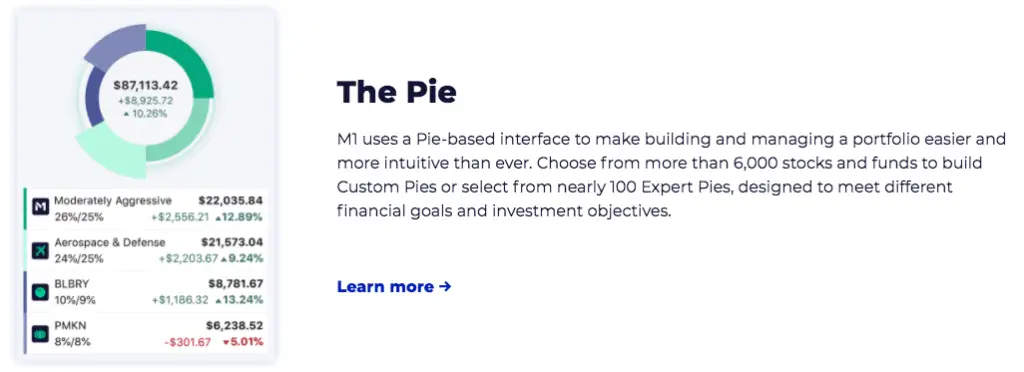

M1 Finance was founded in 2015 and is one of the few hybrid brokerage accounts on the market. It is a hybrid brokerage because it combines robo-investing and do-it-yourself investing through it’s Pie Investing Strategy.

Investing in M1’s Pie Strategy is straightforward. You simply set your asset allocation for various ETFs and stocks, and any new funds you contribute to M1 Finance get automatically distributed to multiple investments based on your desired allocation.

M1 Finance Details:

| Type: | Robo-Advisor |

| Management Fee: | Free |

| Minimum Deposit: | $100 |

| Types of Investments: | Stocks, ETFs |

| Account Types: | Brokerages, IRAs, Trusts |

| Best For: | Self-Directed Investors |

M1 Finance Pie Example

To help bring the M1 Finance experience to life, let’s walk through a quick example of how it’s pie investing works.

Let’s say you want to primarily invest in broad ETFs but also want to invest in a few stocks:

- 75% in a stock ETF

- 10% in a bond ETF

- 5% in individual stock A

- 5% in individual stock B

- 5% in individual stock C

You now have a pie made up of five investments. When you go to invest your first $100, it will automatically invest your funds as followed:

- $75 in a stock ETF

- $10 in a bond ETF

- $5 in individual stock A

- $5 in individual stock B

- $5 in individual stock C

You don’t need to manually allocate $75 to the stock ETF or $5 to an individual stock. You simply deposit $100, and the money is automatically assigned to the investments based on your pie. Plus, because M1 Finance offers fractional shares, you can invest small amounts of money into individual stocks, even if the stock costs hundreds of dollars on its own.

You can now see why this is a hybrid approach – you need to take some time to set up your pie, but after that, investing is passive as M1 Finance does the work for you.

This service becomes even more useful when you need to adjust your asset allocation. For example, let’s say Stock A doubled in value and your bond fund took a decline. On the second $100 you invest, it will not disperse evenly to each investment like it did the first time (with $5 going to stock and $10 going to the bond fund).

Instead, funds will be contributed in a way to get you back to the 75/10/5/5/5 split you have set up. In this example, that would mean investing less in Stock A and more in the bond fund.

With M1 Finance and their pie investing strategy, this rebalancing is done for you every time you make a deposit.

M1 Finance Pros:

- Low Cost: There is no management fee, trades are free, and the available ETFs have low expense ratios.

- Pie Investing Strategy: A good option for investors who want to “set it and forget it.”

- Low Account Minimum: You only need $100 to get started.

- Investment Options: Offers stocks and low-cost ETFs.

M1 Finance Cons:

- No Tax-Loss Harvesting: A service that many other robos offer.

- Limited to One Daily Trading Window: This is not a huge con, but it is a setback for anyone who wants to trade stocks throughout the day.

- Limited Advice Offered: Does not offer goal setting or personalized advice like some other robo-advisors.

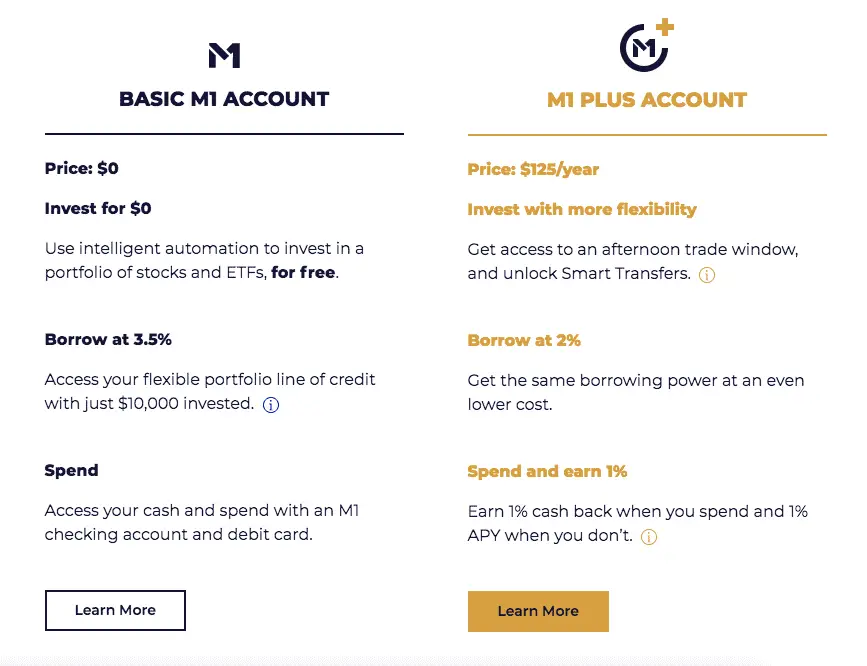

M1 Plus Account:

M1 Finance also offers a premium account called M1 Finance Plus. For $125 per year, you get access to:

- Afternoon trading windows

- The ability to borrow at a lower interest rate (through the M1 Borrow offering)

- Better interest rates and cash back with an M1 Finance checking account and debit card

I think the basic M1 Finance Account is a great place to start for most people. It’s probably a great place to stay long term too, but over time you can decide if the perks of the Plus account are worth the extra cost.

Get Started with M1 Finance:

Betterment Overview

Betterment launched in 2010, and one was of the first robo-advisors on the market.

Today, it’s one of the biggest robo-advisors with over $18 billion in assets under management (AUM). It’s big for a good reason, too – Betterment offers a top-notch service for its price and is arguably the best modern investing platform.

Betterment Details:

| Type: | Robo-Advisor |

| Management Fee: | 0.25% Management Fee |

| Minimum Deposit: | $0 |

| Types of Investments: | ETFs |

| Account Types: | Brokerages, IRAs, 401(k)s, Trusts |

| Best For: | Beginners or Hands-Off Investors |

Betterment offers two different plans, a digital investing plan with a 0.25% annual management fee and a premium investing plan with a 0.40% annual management fee.

For most people, the digital plan will work. However, if you are looking for more hands-on advice from Certified Financial Planners (CFPs), you should opt for the premium plan. Just note, it costs more and has a $100,000 minimum account balance.

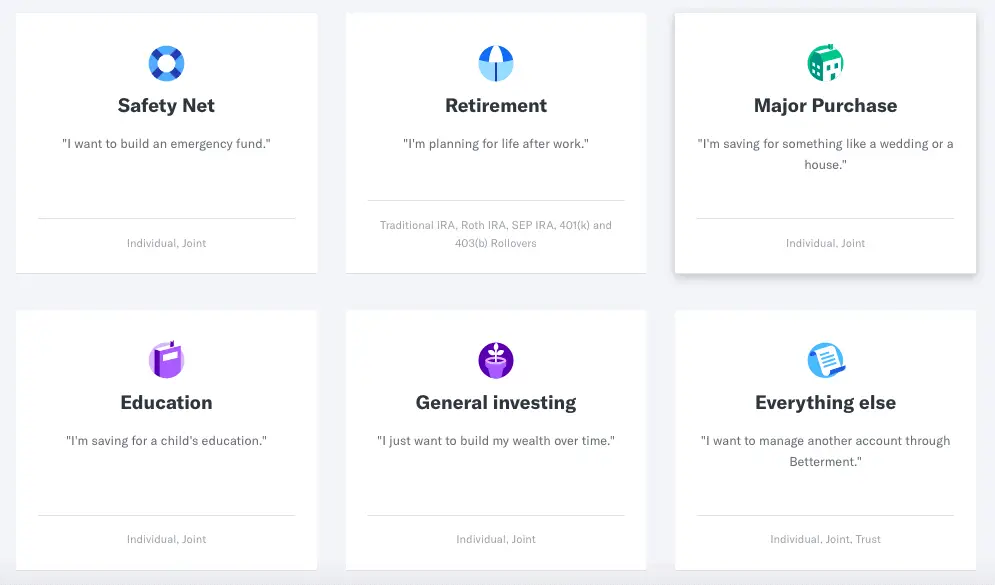

Compared to M1 Finance, Betterment is more of a full-service robo-advisor. Instead of choosing your own ETFs and stocks, you’ll go through three simple steps to get started with Betterment:

- Answer a few basic questions

- Select a plan and goal

- Connect your bank

From there, Betterment will set up your account and provide ongoing account management based on your preselected goals. And that is the major difference between Betterment and M1 Finance – the goal-setting system Betterment has set up.

Betterment offers goals in the following categories:

- Safety Net: Building an emergency fund.

- Retirement: Planning for life after work.

- Major Purchase: Savings for something, like a wedding or a house.

- Education: Savings for a child’s education.

- General Investing: Building wealth over an investment time horizon.

- Everything Else

Betterment takes into account your specific financial aspirations to make portfolio recommendations. You can sit back and be a more passive investor.

Betterment Pros:

- Automatic Tax-Loss Harvesting: Betterment offers tax minimization solutions, including the automated process of tax-loss harvesting.

- Easy Set-Up: Getting started is easy and primarily involves answers a set of basic questions.

- Completly Passive Investing: By presetting your goals, you will be a more passive investor and let Betterment do more of the heavy lifting.

- Personalized Advice Available: With the premium plan, you get unlimited access to CFPs.

Betterment Cons:

- High Management Fee: The management fee is low compared to most money managers and some mutual funds but still adds an increased cost when compared to investing in index funds and ETFs on your own.

- Lack of Flexibility: As expected with these robo-advisors, the tradeoff of having a robo-advisor do the work for you is that you have less autonomy and flexibility to make specific investment decisions.

Get Started with Betterment:

Vanguard Digital Advisor Overview

Vanguard is best known for being a leading brokerage account for index investors. After all, their founder, John Bogle, is widely regarded as the father of index funds.

Vanguard also offers a few other services, including its Vanguard Personal Advisor Services and its Digital Advisor, which we will be reviewing today.

Vanguard Details:

| Type: | Robo-Advisor |

| Management Fee: | 0.15% Advisory Fee |

| Minimum Deposit: | $3,000 |

| Types of Investments: | ETFs |

| Account Types: | Brokerages, IRAs |

| Best For: | Vanguard Loyalists |

Vanguard digital advisor is a very new offering on the market. In fact, it’s so new that they have an entire “pilot” section in their terms and conditions. Here is a snippet from it:

“The Site may not operate correctly, may not be available at all times, and may be substantially modified or withdrawn at any time during

the Pilot period.”

To me, it seems like Vanguard is testing the waters here. They offer some solid features, including a bare-bones “goal setting” system similar to Betterment and a slightly lower fee. At least at this point, nothing revolutionary is sticking out to me about this new service.

Vanguard Pros:

- Passive Investing: Vanguard offers passive investing and goal setting for a relatively low cost.

- Vanguard Brand: Even though it’s a new product offering, it’s not a new company. Vanguard has a reputation for being a low cost and effective investing platform.

Vanguard Cons:

- Relatively High Account Minimum: There is a $3,000 account minimum.

- Management Fee: A fee is a fee, and 0.15% will add up as your money grows. As this product offering evolves, you need to make sure the benefits outweigh the cost.

- Lack of Flexibility: Vanguard digital advisor only offers four ETFs right now.

- No Tax-Loss Harvesting: Tax-loss harvesting is not currently offered.

- New Service: It’s a new service, and you might experience growing pains if you are one of the first people to sign up.

Vanguard Personal Advisor Services:

Like Betterment’s premium plan, Vanguard offers a more premium service: Vanguard personal advisor services.

Here are some quick facts:

- Account Minimum: $50,000

- Management Fee: 0.30%

Vanguard offers personal finance advice and retirement planning (with a real human advisor!) through this service for a reasonable price.

Get Started with Vanguard:

Other Robo-Advisors

While these are three of the biggest and best robo-advisors, they are not your only options. Here are a few others you can look into and consider:

- Blooom: a robo-advisor that specializes in 401(k) optimization. Check them out to get your free 401(k) check-up!

- Wealthfront: offers a comparable product to Betterment.

- Schwab Intelligent Portfolios: Schwab’s version of a robo-advisor.

M1 Finance vs Betterment vs Vanguard Comparison

Management Fees

- M1 Finance: $0

- Betterment: 0.25% – 0.40%

- Vanguard: 0.15%

M1 Finance has the lowest management fee at $0 for their basic account. Though they also offer the least value-added services.

Betterment charges a 0.25% annual fee for this basic plan, but in return, offers a unique goal-setting strategy and tax-loss harvesting. It is truly a full-service robo, and it’s up to users to decide if the 0.25% fee ($25 per $10,000 invested) is worth the cost.

Vanguard occupies the middle ground between the two.

Keep in mind – this is just the management fee. Any ETF you invest in within these brokerages will also charge a small expense ratio.

Goal Setting

- M1 Finance: None.

- Betterment: Yes.

- Vanguard: Yes.

With M1 Finance, you need to create your own pie to invest in or choose from one of their preselected expert pies.

Vanguard and Betterment offer services that will provide a portfolio recommendation based on the goals, risk tolerance, and information you provide. This customization allows you to be more of a passive investor and have a fully automated investing experience. It’s a nice feature for beginner investors who need some help getting started.

Investment Accounts Offered

- M1 Finance: Brokerages, IRAs, Trusts

- Betterment: Brokerages, IRAs, 401(k)s, Trusts

- Vanguard: Brokerages, IRAs

All three of these accounts offer both a brokerage account (taxable account) and some type of tax-advantaged account, like an Individual Retirement Account (IRA). For those saving and investing for retirement, this is a huge perk.

I’ll call Betterment the “winner” in this category because they continue to add more products, services, and flexibility for investors as they’ve built out their platform.

Types of Investments Available

- M1 Finance: Stocks, ETFs

- Betterment: ETFs

- Vanguard: ETFs

M1 Finance, Betterment, and Vanguard offer low-cost ETFs as their primary investment vehicle for investors. Again, the offerings here are top-notch, and you won’t find any high fees or expense ratios in most of the ETFs.

The difference is that Vanguard only offers 4 ETFs in their new service. To be honest, though, you probably don’t need more variety than that.

M1 Finance also offers the ability to trade stocks, which makes this robo a good option for someone interested in investing in individual stocks on their own.

Last, if you are interested in socially responsible investing, both M1 Finance and Betterment offer a socially responsible fund.

Account Minimum

- M1 Finance: $100

- Betterment: $0

- Vanguard: $3,000

M1 Finance and Betterment have a comparable minimum investment, while Vanguard is slightly higher. For a new investor, putting $3,000 into an account might be out of reach.

Keep in mind, Betterment’s premium plan does have an account minimum balance of $100,000, and Vanguard’s personal advisor services requires at least $50,000.

Tax Loss Harvesting

- M1 Finance: No.

- Betterment: Yes.

- Vanguard: No.

Betterment is the only robo-advisor of the group to offer a robust tax-loss harvesting automatic service. It’s one of the most touted services Betterment provides, and I’d assume it is why many people deem them “worth it” despite the 0.25% management fee.

Customer Support

- M1 Finance: Support page; phone number is 312-600-2883.

- Betterment: Contact Page.

- Vanguard: Support page.

All three brokerages offer phone support during the week. To me, this is a huge perk. Sometimes I think it’s easier to hop on the phone than deal with something over chat or email – especially when dealing with your hard-earned investments and retirement savings.

One call out, while Vanguard as a brokerage has dependable customer service, I’m not sure everyone is trained with their new digital advisor product.

Security

- M1 Finance: SIPC Insured

- Betterment: SIPC Insured

- Vanguard: SIPC Insured

All three brokers are SIPC Insured, which covers up to $500,000 and includes a $250,000 limit for cash. In addition, all three are a member of the Financial Industry Regulatory Authority (FINRA).

This is standard, and you shouldn’t consider a broker who doesn’t meet these standards.

Start Investing Today:

Summary: M1 Finance vs Betterment vs Vanguard Review

When comparing M1 Finance vs Betterment vs Vanguard Digital Services, I found that you can’t go wrong with any choice. However, they are all catered slightly to specific investor needs.

- M1 Finance: The hybrid model.

- Betterment: The original, full-service robo.

- Vanguard: An essentials-only offering.

If you are a self-directed investor and want some control over your investments, M1 Finance will give you some control while automating other aspects of the investing experience.

However, if you are looking for a true robo-advisor experience, Betterment and Vanguard are likely better options. From there, you can decide if the slightly higher fee of Betterment is worth it to get access to a more robust and established robo-advisor, as well as tax-loss harvesting.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.