The Mercury Credit Card, or Mercury Mastercard, is a middle-tier credit card that requires average credit to attain. It’s also one of the most confusing personal finance products I’ve come across so far.

Let me explain…

For one, it’s unknown if the Mercury Card offers any rewards. There is nothing to be found regarding rewards on their website, but some users are leaving card reviews that mention them. I’ll get into more of the details later.

To add to the oddness, this is an exclusive, mid-tier credit card that requires a sign-up code to apply. I never expected to describe a credit card as both “exclusive” and “mid-tier,” but that’s what this is and you cannot apply unless you get an invitation through the mail.

At the end of the day, I believe there are better, less-mysterious middle-tier credit cards for someone with fair credit.

The Best Credit Cards for Building Credit:

If you are interested in the Mercury card, or at least interested in learning more about this card, I’ve compiled everything that I know below in this Mercury Credit Card review.

And if you have the Mercury Credit Card, please shoot me an email, I’m dying to know more.

Mercury Credit Card Overview

The Mercury Mastercard is issued by First Bank & Trust. The card was created a few years back when Barclays sold about $1.6 Billion in “risky” credit card balances to CreditShop, who then created the Mercury Card (full WSJ report here).

Despite all the uncertainty surrounding this interesting credit card, one thing is known – it’s a good no annual fee card for building your credit.

Below are some more details on the card.

Mercury Credit Card Key Specs:

Key Details:

- Regular APR: 25.65% to 28.65% at the time of publishing this review (variable)

- Initial Credit Limit: Varies

- Credit Reporting: Reports to all three major credit bureaus

- Fraud Liability: $0 fraud liability and protection

Fees:

- Annual Fee: $0

- Foreign Transaction Fee: 3%

- Late Payment Fee: Up to $38

- Balance Transfer Fee: Either $5 or 4% of the amount of balance transfers, whichever is greater

- Cash Advance Fee: Either $10 or 5% of the amount of cash advances, whichever is greater

Sign-Up Bonus and Rewards:

- Sign-Up Bonus: Unknown – assumed to be $0

- Rewards: Unknown – some users state there are rewards, others don’t

Other:

- Credit Card Application: You can only apply with an invitation and reservation code

- Customer Service: Per their website, cardholders can call 866-686-2158 for Mercury customer service agents to assist them 24/7

Mercury Mastercard Pros and Cons

The Mercury Credit Card is best used for building your credit from fair to good.

Experian has a reputable definition and ranking of credit scores:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

As previously mentioned, this card is best for someone with a fair credit score, which is a step above very poor credit (bad credit) and no credit. At least, from what we can gather, it seems like people with fair scores are getting the ones getting sign-up codes to apply.

Since this card has no annual fee, it can be a good option to build your credit score from fair to good, and hopefully even higher. Specifically, there are three components of your credit score that this card can help build:

- You don’t have to worry about canceling this card since there is no annual fee, which builds your credit history

- You will get an additional credit limit with this card, helping to lower your credit utilization

- If you make your credit card payments on time and in full every month, as you should, it will help build your payment history

If interested, you can learn more about how your credit score is calculated here.

Mercury Card Pros

Pro 1: No Annual Fee

The Mercury Mastercard offers no annual fee, making it a great low-cost card to help build credit in the long run.

Pro 2: Rewards?

Well… I think the Mercury card offers rewards (skip to the reviews below to see what I mean). Whether they are cash rewards, travel rewards, or some other type of rewards, I have no idea.

If there are any rewards, that’s great.

If not, well, that’s why this pro has a question mark after it.

Pro 3: Multiple Smaller Perks

Mercury cardholders receive other perks that I view as table-stakes for a mid-tier credit card:

Free FICO Score: You can also check your score for free with Credit Karma, or you can get a free credit report from annualcreditreport.com. This is a nice thing for a card to offer, but not a game changer.

Fraud Protection: This is an awesome perk to protect against credit card fraud, but is standard with most cards these days.

Mobile App: Again, an app isn’t groundbreaking and it’s another feature that is commonplace with most credit cards.

Merchant Acceptance: Most merchants accept Mastercards nationwide.

Mercury Card Cons

Con 1: High Interest

The Mercury Credit Card has a relatively high interest rate, or APR (annual percentage rate). At least, it’s a higher interest rate than most similar cards.

Hopefully, this never comes into play because you make your payments on time and in full every month. At the end of the day, you most likely are looking at the Mercury Card because you want to build your credit, and making on-time payments is how to do it. Avoiding credit card debt is almost always a good strategy.

Though, life and unexpected things happen. So if you find yourself needing to pay an APR for a period of time, the lower it is, the better.

Con 2: Foreign Transaction Fee

If you’re not traveling internationally, the 3% foreign transaction fee won’t matter to you.

However, the 3% fee will add up for someone who is planning to use this card abroad.

Con 3: Sign-Up Code Required

Even if you are interested in the Mercury Card, you cannot just go out and apply for it. Remember, it’s the most exclusive mid-tier credit card out there.

You need to wait for Mercury to select you to even get the opportunity to apply.

Con 4: Difficult to Find Information

Last, and most importantly, this card is too mysterious for my liking.

The cardholder agreement available online is vague, leaving out crucial pieces of information, like whether or not they have a rewards program.

Maybe they provide more details when you get a sign-up code from them in the mail, but if not, there is simply not enough information out there on this card.

Is the Mercury Credit Card Worth It?

The Mercury Credit Card is a fine card for someone with fair credit who wants to improve their credit score. Honestly, though, it is hard to say much more on the card.

I don’t even know if it offers rewards!

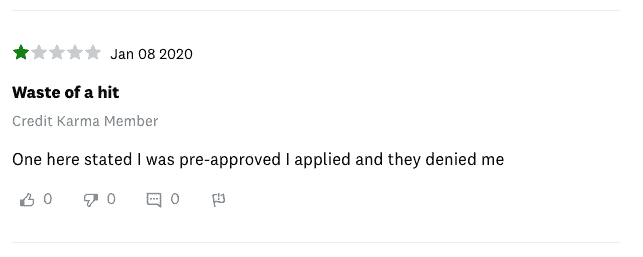

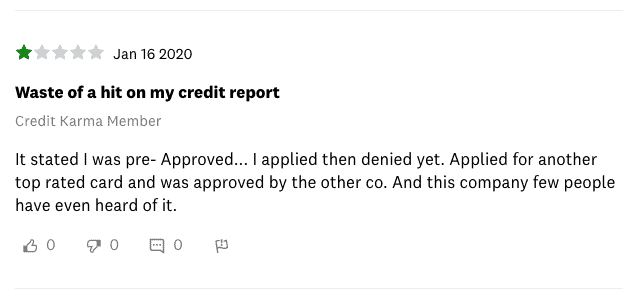

Plus, it seems as though their pre-approved offers and sign-up codes are not exactly as good as they sound. Some people reported getting denied for the card after supposedly being pre-approved – which dings your credit in the short term.

Not cool.

Below are some of the reviews I found on Credit Karma to help provide some more info on this card.

Mercury Credit Card Reviews

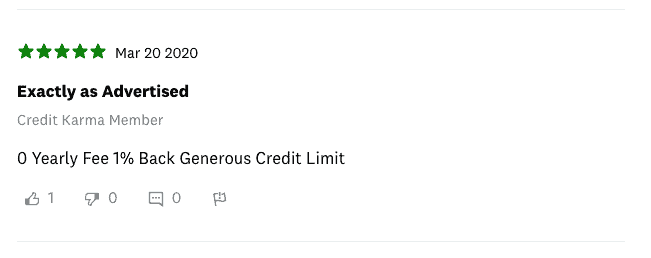

This reviewer eludes to a “1% Back” rewards program, but the lack of punctuation makes it hard to draw too many conclusions.

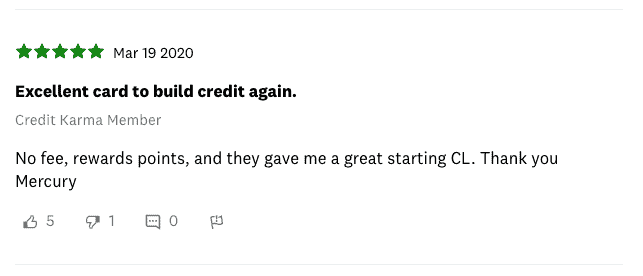

Here’s another review stating there are rewards points, and also mentioning a great starting credit limit. Although, also lacking any specific details.

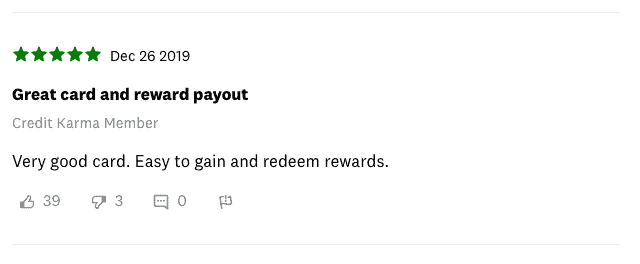

Another mention of rewards, but no details!

Looking at the other end of the spectrum, here’s someone claiming they got denied after being pre-approved. What a rip-off.

Lastly, another person claiming to be pre-approved and then denied.

The morale of the story: apply at your own risk.

And, if you have good credit or better, there are likely better options out there that aren’t shrouded in so much mystery.

Other Options For People with Fair Credit or Good Credit

A huge downfall of the Mercury Credit Card is that you can’t just go out and apply for it. You need to wait to get a sign-up code.

Below are some other options for someone with fair or good credit that you can apply for today.

Explore and Apply for Other Credit Cards Here:

Option 1: Credit One Bank Visa Credit Card

The Credit One Bank Visa Card is unique because it is a beginner credit card that offers rewards. Specifically, 1% cash back rewards on eligible purchases including gas, groceries, and services such as mobile phone, internet, cable and satellite TV (terms apply).

You do need some credit history, like the Mercury card, in order to get it.

Credit One Bank Visa Credit Card Key Specs:

- Annual Fee: $0-$99

- Regular APR: 17.99%-23.99% (variable)

- Security Deposit: $0

- Rewards: 1% cash back (on eligible purchases)

- Starting Credit Limit: $300

- Foreign Transaction Fees: 3%

Option 2: Credit One Bank Platinum Rewards Visa

The Credit One Bank Platinum Rewards Visa card is an average credit card offering the costs, perks, and a long name often attributed to premium credit cards.

It charges a hefty $95 annual fee, but offers 5% cash back on your first $5,000 spent in certain categories (worth $250 if you max that out). Plus, it is not as hard to get approved for this card compared to most other high reward credit cards.

Credit One Bank Platinum Rewards Visa Key Specs:

- Annual Fee: $95

- Regular APR: 23.99% (variable)

- Security Deposit: None

- Rewards: 5% cash back on the first $5,000 of eligible gas, grocery, internet, cable, satellite TV, and mobile phone service purchases each year, and then 1% thereafter and on everything else

- Starting Credit Limit: $300

- Foreign Transaction Fees: 3%

Option 3: Citi Double Cash Card

The Citi Double Cash Card is the hardest card to get on this list, but it is arguably the best credit card for building credit and reaping really strong rewards in the meantime (in the form of cash back).

They don’t charge an annual fee and offer 2% cash back on every purchase (1% at purchase, plus an additional 1% at pay off).

Citi Double Cash Card Key Specs:

- Annual Fee: $0

- Regular APR: 13.99% – 23.99% (Variable)

- Security Deposit: None

- Rewards: 2% cash back on every purchase (1% at purchase, plus an additional 1% at pay off)

- Starting Credit Limit: Varies

- Foreign Transaction Fees: 3%

Summary: Mercury Credit Card Review

If you find yourself lucky enough to be chosen to apply for the Mercury Credit Card with a sign-up code, it could be a good option for building credit.

The fact that it has no annual fee makes it a low-risk card to apply for, except for as you saw in reviews, you might end up getting denied anyway. Which would result in an unfortunate short-term decline to your credit score.

In my opinion, there are likely better, less mysterious credit cards for someone with fair credit that you can apply for in order to build your credit today.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.